salt tax limit repeal

This significantly increases the boundary that put a cap on the salt deduction at 10000 with the tax cuts and jobs act of 2017. A 10000 ceiling on the previously unlimited SALT deductions was enacted and made applicable for taxpayers between 2018 and 2025.

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

President donald trumps 2017 tax reform.

. The TCJA paired back the AMT reducing the number of taxpayers subject to it from about 5 million in 2017 to 200000 in 2018. The TCJA also repealed the Pease limitation. Repeal the SALT deduction limit for LIers.

Individual taxpayers who itemize their. The so-called SALT tax. In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep.

The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes above 500000. After donald trumps 2017 tax. The SALT deduction is only available if you itemize your deductions using Schedule A.

This significantly increases the boundary that put a cap on the SALT. Tom Suozzi writes For 100 years Americans relied on. Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT.

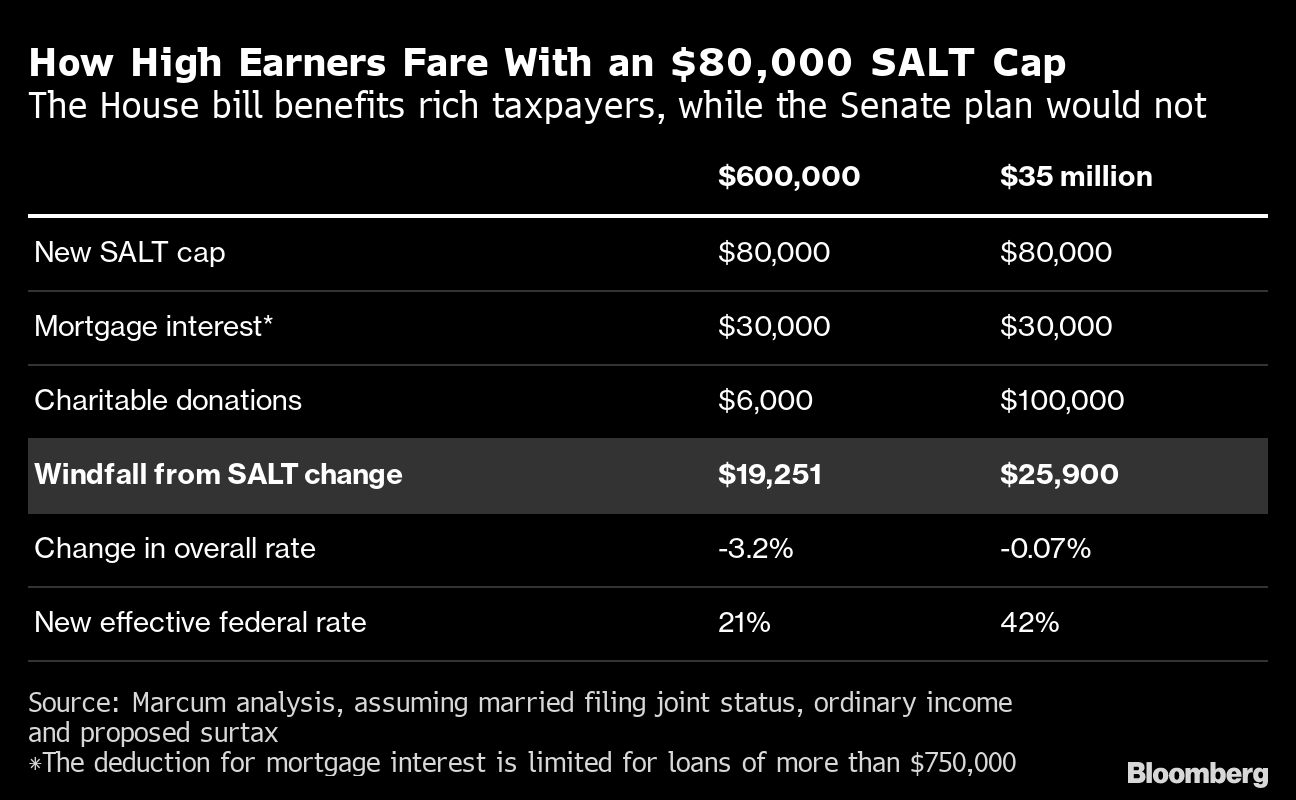

Accordingly the taxpayers 2018 SALT deduction would still have been 10000 even if it had been figured based on the actual 6250 state and local income tax liability for. New limits for SALT tax write off Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. Blue-state Democrats have been fighting since 2017 to repeal a key provision of President Trumps tax plan that penalized high-cost California filers.

Raising or repealing the 10000 limit on the SALT deduction a change imposed by the 2017 Republican tax overhaul is one of the most politically charged aspects of the. 2 2022 1042 am ET. Sanders would partially repeal the SALT cap.

For your 2021 taxes which youll file in 2022 you can only itemize when your. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break. 54 rows Some higher-income earners still disproportionately benefit from the.

Senate Budget Committee chair Bernie Sanders will include a partial repeal of the Tax Cut and Jobs Acts 10000 cap on the. The lawmakers have asked the. The so-called SALT deduction cap which is poised to sunset in 2026 limits the amount of state and local taxes that Americans can deduct from their federal taxes to.

House Democrats who are pushing to lift a 10000 fixed cap on state and local tax SALT deductions said they will support the Inflation Reduction Act which passed the. Tom Suozzi Mikie Sherrill and Josh Gottheimer insisted that the 740 billion so-called Inflation Reduction Act would not raise taxes on individuals despite a recent. Salt Tax Cap Repeal 2022.

If repealed completely the top 20 of taxpayers may see more than 96 of the relief according to a Tax Policy Center report affecting only 9 of American households.

Nj Representatives No Salt Cap Repeal No Budget Support

Salt Cap Repeal Democrat Tax Plan Will Benefit Top Earners In High Cost Areas Bloomberg

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Democrats Pressure Biden To Repeal Salt Deduction Cap

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Local Officials Push To Repeal Salt Deduction Cap

House Democrats Working To Nest Salt Cap Repeal Into Reconciliation Package

Salt Deduction Cap Repeal Gottheimer And Suozzi Discuss Tax Cuts

Sen Charles Chuck Grassley On Repealing The Salt Tax River Cities Reader

Left Leaning Group Salt Cap Repeal Would Worsen Racial Income Disparities The Hill

House Democrats Push For Repeal Of Rule Blocking Salt Cap Workaround

Black Hispanic Families Would Benefit Less From Salt Cap Repeal

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

House Panel Votes To Temporarily Repeal Salt Deduction Cap The Hill

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

House Democrats Push For Repeal Of Rule Blocking Salt Cap Workaround

Rep Steel Joins Colleagues To Launch Bipartisan Salt Caucus Representative Michelle Steel

Democrats Push For Agreement On Tax Deduction That Benefits The Rich The New York Times